Calculating Property Tax

[FREE COURSE] Explore the foundations of property tax calculation and its significance in promoting the economic stability and growth in Minnesota cities.

If you would like to save the page you’re viewing as a PDF document, here are the steps:

View additional instructions for the most common browsers.

Learn the nature of a city’s decision-making authority and the legal standards associated with variances, conditional use permits, and nonconformities.

Keep your land use ordinances up to date in key areas to avoid land use problems and claims.

Explore how to create a written explanation of a land use decision to make defensible decisions.

Design a sign ordinance for your city that meets First Amendment requirements for protecting various forms of speech.

Learn about variances as a way cities may allow an exception to part of their zoning ordinance.

What a city can do about land uses or structures that don't comply with its current zoning ordinance.

Learn the basics of conditional use permits (CUPs) in administering the city’s land use ordinances.

Protect city authority to make development fee on housing cost decisions based on locally identified needs.

Understand the cities' role in developing and maintaining quality housing stock and the infrastructure that supports it.

This economic development tool can affect a city's tax base and LGA distribution when its districts are decertified.

[FREE COURSE] Explore the foundations of property tax calculation and its significance in promoting the economic stability and growth in Minnesota cities.

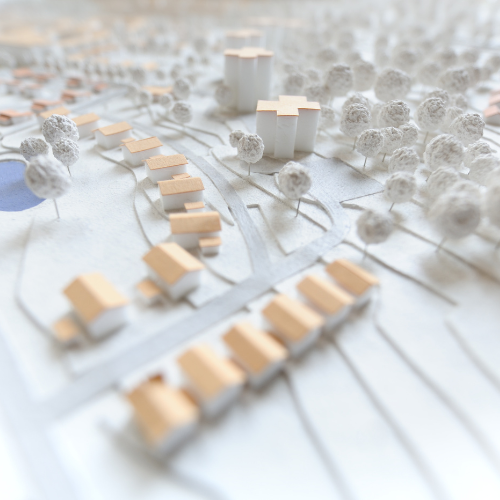

This course is designed to introduce you to core concepts about land use decisions.

[FREE COURSE] This mini course is designed to introduce you to core concepts about land use decisions.